Several obstacles have confronted Tesla Inc throughout the last few months which worry shareholders and analysts from the automotive industry.

The market capitalization value recorded a major downturn for Tesla the electric vehicle giant causing investors to question its leadership practices and business strategies.

The share price of Tesla declined by about 50% starting from December 2024 which resulted in over $800 billion removal from its market value.

The market value loss stems from both escalating electric vehicle industry rivalry and general economic difficulties.

Changes in Tesla’s financial outcomes have recently faced evaluations because the company missed its vehicle shipment predictions in the most recent quarter.

Several analysts with JPMorgan leadership among them now present revised evaluations about Tesla’s upcoming performance that show increased prudence.

The involvement of Elon Musk in governmental roles poses further anxiety among investors because of his position at Donald Trump’s Department of Government Efficiency (DOGE).

Some people view Musk’s political activities positively yet others believe the involvement hinders Tesla development.

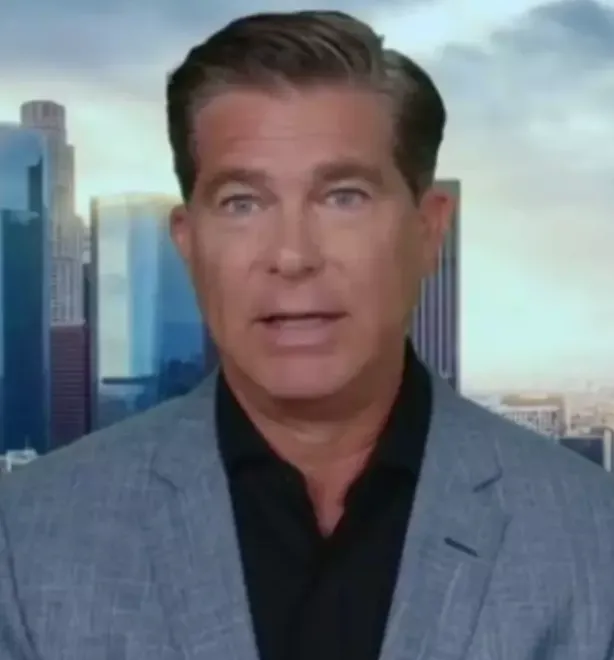

Credit: (Youtube/Sky News)

Dan Ives, a top analyst at Wedbush Securities, described the situation as a “crisis” and urged Musk to clarify his role at Tesla.

Shareholders are demanding Tesla to disclose details about its planned budget-friendly cars and Full-Self Driving (FSD) deployment as this self-drive feature remains vital for their sales prospects.

Operational setbacks currently affect the company because the company recalled 46,000 Cybertrucks because of an exterior panel defect.

The rising demand for better quality from Tesla comes together with its production growth because investors wonder if the company can maintain its reliability standards.

The public image of Tesla suffered because of protests together with boycotts stemming from Musk’s political relationships.

Tesla faces such serious security issues that authorities banned the company from participating in major auto shows including the Vancouver International Auto Show.

The problems facing Tesla have amplified investor and analytical calls for executive leadership transition throughout the company.

Top investor Ross Gerber has announced publicly that Elon Musk should give up his position as CEO.

The CEO’s dedication to outside projects has according to Gerber caused Tesla to receive poor corporate image and detrimental neglect of the company’s business operations.

“The company’s reputation has just been destroyed by Elon Musk. Sales are plummeting, so yeah, it’s a crisis,” Gerber stated in an interview with Sky News.

The company requires a permanent CEO who will support Tesla through its present business hurdles according to him.

“Either Elon should come back to Tesla and focus entirely on it, or he should find a suitable CEO to run the company,” Gerber insisted.

Such outspoken demands for Musk’s resignation from a notable investor constitute a first for the company and bring uncertainty to Tesla’s future path.

The absence of any public remarks from Musk to Gerber regarding the comments has resulted in investor concern about Tesla’s future direction.

The direction of Tesla depends on whether Elon Musk will resolve existing concerns or whether a substantial leadership change will happen.

Feature Image Credit: (Instagram/elonrmuskk) (Youtube/Sky News) (CanvaPro) (Shutterstock) and (AP)